Join The Movement That Transforms Lives

Become a member and enjoy our benefits to improve your life. We exist solely for the benefit of our members/owners.

You Are Eligible If…

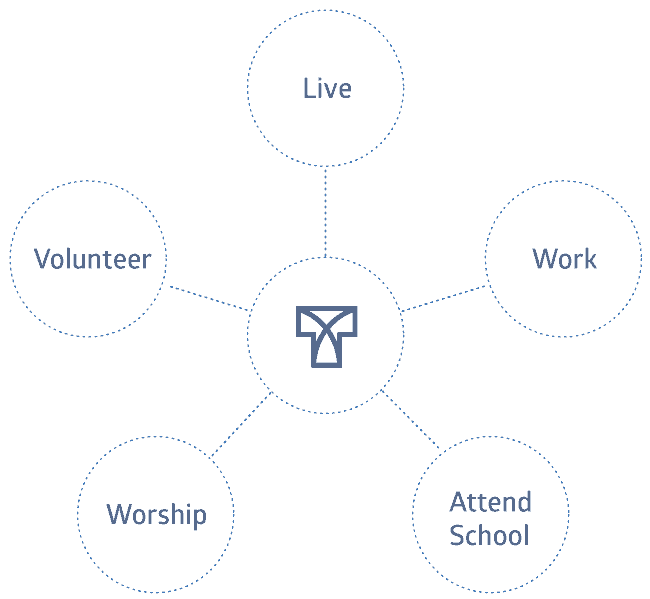

You live, work, volunteer, worship or attend school in Pima County or if you are an immediate family or household member of someone who satisfies one of the previous criteria.

With Tucson Federal Credit Union membership, you become an owner and you contribute to the local economy. Because our bottom line goes back to our members and our community, you’re doing yourself a favor too. We aim to save you money with lower interest rates and fewer fees.

What Can You Expect As A Member?

Tucson Federal Credit Union is a Non-for-Profit financial cooperative, owned by its members who save and borrow. We return our earnings in the form of lower rates, higher dividends on deposits and lower fees. Learn more about our member benefits.

Are you ready to Join?

We’re happy that you’re considering becoming our member-owner, and we’re excited for you to make your next move. If you’re ready to join, start your application now!